"Net Zero" and the end of our pensions

Your retirement, my friend, is twisting in the wind.

TWO RELATED VIDEOS appeared last week, both toe-curling in their own ways.

One was of the UK’s increasingly troubling Secretary of State for Energy Security and Net Zero, Edward Miliband, plucking at a ukulele and singing a ditty about his insane plan to replace the ultra-dense energy that powers the UK’s economy with ultra-diffuse energy scavenged from occasional sunbeams and gusts of wind.

The other video was of a former Bank Of England economist calmly explaining that the UK state pension scheme will become insolvent as early as 2035.1

This week’s essay explains why the latter is the consequence of the former — unless we do something urgently to prevent it.

This isn’t an essay about the ruinous cost of so-called “renewable” energy. While its cost will immiserate most UK households and plunge many retirees into energy poverty for the rest of their shortened lives, electricity cost is not the reason why the pension system will collapse. If it were, it might be argued — however implausibly — that such a risk could be averted by reducing that cost.

No. The reason “Net Zero” will collapse the pension system lies more fundamentally in basic physics, and in the non-negotiable relationship between our energy system and our financial system (and, therefore, our pension).

To understand why, we need a little bit of scientific and economic theory.

I’m qualified in Neoclassical Economics, which is the framework through which western economies reason about how the world works. That framework is broken in many exciting ways.2 But the area in which it is most spectacularly broken is in its understanding of the relationship between the economy and its energy system: it reverses it.

The thing to understand about neoclassical economics — an oxymoronic “social science” — is that it is physically illiterate. That is to say, the majority of neoclassical economists have no significant education in the physical sciences. I came to economics late in my career, with a previous education in maths, physics, electrical, electronic, power, and petroleum engineering. When Hall and Klitgård wrote that neoclassical economic models were: “also enormously and deeply flawed, in a way and to a degree that is almost inconceivable and even an embarrassment to someone who has a background in natural sciences”,3 I knew what they meant.

That illiteracy creates all sorts of intellectual howlers. For example, the quantity of energy in the world is what neoclassical economists refer to as “an irrelevant, non-binding constraint”.4 Whenever a stock of energy runs low, they believe, human ingenuity kicks in and we create some more of it. So, for example, since the “renewable” industry appears to get some energy out of a wind turbine, then all it has to do is build millions of wind turbines and — voilà — we can replace our existing energy system with them.5

But that only seems plausible to someone who, lacking an awareness of thermodynamics, doesn’t even know that they don’t know about the thermodynamic concept of energy gradient — analogous to gravity gradient — that says that we can no more replace a gas fired power station by stringing together millions of wind turbines than we can replace a ski run by stringing together millions of ski lift queues.

And that matters, because the critical activities within an industrial economy all require the energy gradient equivalent of a black ski run to operate, and it would grind to a halt (much as we would) if fed with the energy gradient equivalent of a 100 mile long ski-lift queue.

So how does this relate to our pension? There are two pieces to the puzzle.

The first piece is how pensions work, and what’s gone wrong with them. In our state pension (I’ll say a little about private schemes at the end), we don’t “save up for our retirement”. When we started the system after the war, we needed to pay retirees immediately. Pensions have therefore always been met each month out of taxes paid by workers that month. At any given moment, there is only a week or two of funds in the government’s “State Pension account”.

While that arrangement solved an immediate problem, it created an enormous structural problem. When the pension scheme was started, life expectancy was about 68. Now it’s about 82. And birth rates started falling in the 1960s, meaning that more and more pensioners incomes are being funded by fewer and fewer workers. The result is that the average person born in 1956 now takes out around £290,000 more in retirement income than she paid over her working life.

The plan for addressing that problem was to grow the economy each year by an amount sufficient to generate enough tax receipts to keep funding the expanding retirement bill. And for most of the 20th century, while we benefitted from a global hydrocarbon and nuclear energy system that for decades doubled in size every 7 years, that plan worked.

“Net Zero” puts an end to that.

The second piece of our puzzle is how different levels within the economy work, and the relationship between energy and money.

The economy is a hierarchy, with three levels:

The level of energy and resources and things made from them — I dig up some coal, melt some iron ore, make a shovel, dig some ground, plant some seed, and eat.

The level of services — I rent my labour and my shovel out to you, dig your ground, and you give me a sheep in return.

The level of money and finance — instead of giving me a sheep, you give me a token, called “money”, and I give that token to someone else in exchange for something. That thing might have physical value. Like a sheep. Or not. Like a Netflix subscription.

The first thing to notice about this hierarchical system is where the things you need to stay alive with — food and energy — are located: the primary level.

In the secondary level, you use the energy you obtain from your food, and the shovel you made, to trade your labour. But what you eat, and the shovel you use, are products of the primary level.

The second thing to note is that not everything in an economy is of real value, and nothing in the tertiary level — the level of money and finance — is. The only physical use for the product of the tertiary level — money tokens — is that you can set fire to them and either stay warm with them or cook a sheep with them. Yes, I can sell you a Netflix subscription. And, yes, you can give me money tokens for it. But if a malfunction takes place in the economy’s primary level — say, if your government wilfully destroys your country’s energy system — well, let’s say there’s not much eating in a Netflix subscription.

Neoclassical economists suppose that you can create sheep and shovels by printing money. Which is true. If you have energy. (This, by the way, is their fatal “reversal” error, caused by their energy blindness). They also suppose that we can solve our energy deficit problem with “technology” — a strategy humans have devised for solving many problems with. But since technology requires a surplus of net energy, the one problem that technology can’t solve is a deficit of energy.6

The third thing to notice about this hierarchical economic system is what controls the quantity of money tokens — i.e. our pensions (amongst other things).

Money tokens “stand in for” goods and services. To do that, the quantity of money tokens has to remain proportional at all times to the quantity of goods and services they stand in for. That’s one reason why we don’t use leaves for money. When the quantity of energy and resources increases, the quantity of goods and services can increase. And when the quantity of goods and services increases, the quantity of money tokens can increase.

This operates in reverse. With no energy and resources, we can’t produce goods or services. So if, for whatever reason, the quantity of energy or resources decreases, then the quantity of goods and services will decrease. And if the quantity of goods and services decreases, then the quantity of money tokens has to decrease.

What happens if the quantity of goods and services decreases, and the quantity of money tokens stays the same? In that scenario, there are more money tokens chasing fewer sheep. So the number of money tokens per sheep increases. We call that “inflation”.

Inflation — the increase in the ratio between money tokens and the goods and services they stand in for — also happens if you hold energy steady and print more money tokens. The UK dumped half a trillion money tokens into its economy during COVID to pay people to sit at home and watch Netflix, instead of going to work to manufacture and sell ballbearings. We’re printing billions more now (over the long run) and giving them to anyone with the power to hold the country to ransom by withholding their labour. You can see the consequences reflected in the supermarket price of sheep.

There are two ways we get poor. By having fewer money tokens. And by having lots of worthless money tokens. When the energy system driving our economy contracts, the only choice available to us is the way in which we get poor.

And so, finally, we have all the pieces assembled to understand what will happen under the “Net Zero” energy policy that Edward Miliband sang so weirdly to us about.

Replacing high gradient energy sources — coal, oil, gas, and nuclear — with low gradient sources — sun and wind — vastly reduces the net amount of energy available to our economy. Reducing the net amount of energy available to the economy reduces the quantity of goods and services that can be produced by the economy. To prevent a catastrophic destruction of the value of money, any government imposing an energy policy that contracts our net energy supply must also impose a policy of controlled withdrawal of money from the economy.

What does “controlled withdrawal of money” look like? For the elderly: reduction in monthly pension; increase in retirement age — ultimately, back to a year or two before death; and withdrawal of state care and medical provision.

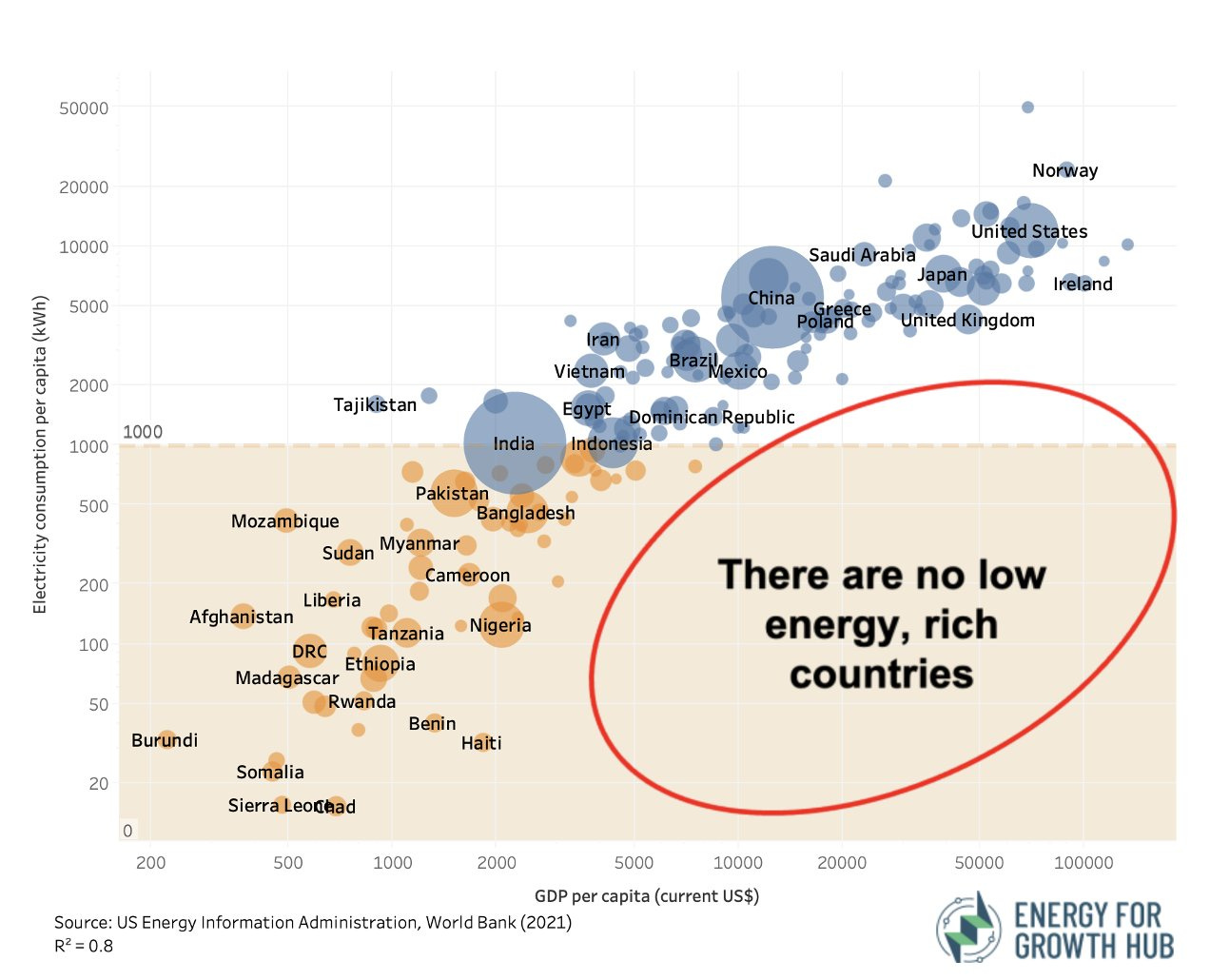

But, while necessary, this will not be sufficient to prevent the impoverishment created by the wilful, energy-led contraction of our economy. “Controlled withdrawal of money” will require the removal of services, and everything normally funded by debt that is paid for later by growth — all transport, health, education and energy infrastructure, for example. To see where “Net Zero” energy policy is taking us, all you have to do is research what life — and life expectancy — is like in those countries that already approximate it. Somalia, anyone?

And it gets worse. You will search in vain for Mr Miliband’s estimate of how much Net Zero is going to cost. He doesn’t know. But that doesn’t mean it has not been estimated. McKinsey’s estimate that achieving Net Zero by 2050 will cost $275 trillion globally.7 Adding in a highly conservative 60% cost overrun to account for the fact that most of the required technologies have not been invented increases that estimate to $440 trillion. That’s 15% or so of a country’s GDP, every year, for decades. In the case of the US, around 9 times what it currently spends on its military. Every year. All funded by debt that can never be repaid, because the growth required to repay it is destroyed by the activity funded by the debt.

The government isn’t planning to reduce the number of money tokens to preserve their relationship with the quantity of things of value in the economy. It’s planning to vastly and irreversibly increase them, destroying the value of everything.

And that’s why the State Pension (and much else besides) will crash as early as 2035.

And for those of us with private pensions: don’t imagine that we are immune. The funds in our schemes aren’t sufficient, with inflation, to fund our retirements. To do that, they will have to grow. And to grow, the companies that our pension schemes invest in will have to make more goods, and provide more services. See above.

Meanwhile, anyone with a private pension scheme would be well advised to check if it has “invested” in so-called “green” companies — companies that confect the illusion of profit by recycling printed money tokens into solar and wind rackets subsidised by taxes imposed on us and paid by us with the same printed money tokens that comprise an increasing fraction of our remuneration. Gordon Hughes (formerly of Edinburgh University Department of Economics) shows how UK wind energy projects — now comprising a significant element of the largest UK pension schemes — are sub-economic and destined for taxpayer bailout when the current Ponzi scheme of subsidies runs out.8

It doesn’t have to be this way. Net Zero will eventually collapse under the weight of its own monumental scientific and economic illiteracy. What’s at stake is how soon it collapses, and therefore how much of our economy is left after it does that can be salvaged.

Only 20% of the British electorate voted for this government and its suicidal “Net Zero” energy policy. Most of us understand, instinctively, that you can’t run an industrial economy on rainbows and zephyr breezes.

So let’s accelerate the collapse of Net Zero together. Talk to your friends. Talk on Twitter. Talk on Facebook. Talk on Instagram. Talk in your church. Talk in your school Parent Group. Talk to your MP. Send this email to anyone you think will benefit from it. However you do it, spread the message.

And the message is: “Just say ‘No’ to Net Zero”.

By the way, Mr Miliband: that’s what’s blowing in the wind.

Marlow, Maxwell. ‘Up in Flames: The State Pension by 2035’. Adam Smith Institute, 2024. https://www.adamsmith.org/research/up-in-flames-the-state-pension-by-2035.

For a thorough review, see Keen, Steve. Debunking Economics: The Naked Emperor of the Social Sciences. Zed Books, 2001.

Hall, Charles, and Klitgaard, Kent. ‘The Need For A New, Biophysical-Based Paradigm In Economics For The Second Half Of The Age Of Oil’ 1, no. 1 (2006): 19.

“There is no such thing [as an exhaustible natural resource]. The total mineral in the earth is an irrelevant non-binding constraint”. Adelman, M. A. ‘Mineral Depletion, with Special Reference to Petroleum’. The Review of Economics and Statistics 72, no. 1 (February 1990): 1. https://doi.org/10.2307/2109733

In reality, you only appear to get some energy out of a wind turbine over its economic life if you ignore the vast amount of energy you’ve had to incur to manufacture it. See my previous essay, “On the edge of a cliff” (29 June 2024).

The limitation on the amount of your time I can ask you for in these essays obliges me to treat a number of important claims rather briefly. This is the most important one that I have to simply state, but which you may want to take a moment to think about the consequences of.

McKinsey (2022) A net-zero economy: The impact of decarbonization. McKinsey Sustainability. Available at: https://www.mckinsey.com/capabilities/sustainability/our-insights/the-economic-transformation-what-would-change-in-the-net-zero-transition (Accessed: 25 January 2023).

Hughes, Gordon. ‘Wind Power Economics – Rhetoric and Reality’. 11 2020. https://www.ref.org.uk/ref-blog/365-wind-power-economics-rhetoric-and-reality.

Thank you for a very thought provoking and accessible piece, I will be sharing this widely 👍

That sentence about there are no rich low energy countries stood out. The Labour govt said it's going to invest pension money in 'things' ( can't recall what) which will benefit the whole economy.....maybe it's just the large scale manufacture of ukuleles.